Responsible Investing is a practice to incorporate environmental, social and governance (ESG) factors into investment decisions. Responsible Investing is a growing movement around the world, as more investors seek to align their investments with their values.

Responsible Investing strategies will vary between individuals and across organizations. For HCTF, our motivations were threefold:

- Reduce the financial risks associated with the climate crisis and stranded assets, such as fossil fuels remaining in the ground as a result of the transition to clean energy

- Align our investments with our values

- Provide an avenue for donors and partners to have their contributions make an even bigger impact

- Reducing our Risk

Climate impacts, including extreme weather patterns and rising global temperatures, pose a significant risk to both HCTF’s on-the-ground conservation investments and also our financial investments.

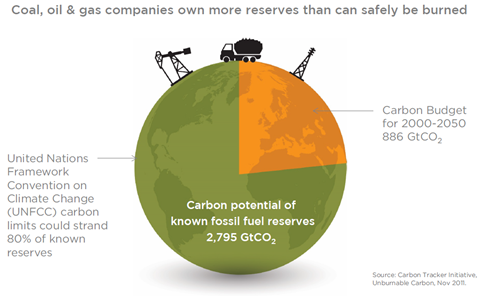

The report by the UN Intergovernmental Panel on Climate Change in October 2018 showed that carbon dioxide levels would need to fall by 40 per cent from 2010 levels by 2030 to keep warming around 1.5C. If governments are to meet the carbon reduction targets necessary to make this possible, climate experts believe much of the existing fossil fuel reserves may be unburnable. And, as the world transitions to cleaner energy sources and adds new regulations, this could result in significant “stranding” of these assets. Since energy reserves are a key part of fossil fuel companies’ valuations, many analysts believe this scenario could negatively affect investment returns.[1]

At HCTF, we believe that to expand our role as a trusted partner in managing conservation funding, we cannot ignore the significant risks associated with climate change, including those present in financial markets.

[1] Genus Capital Report, Climate Change and Your Investments https://genuscap.com/climate-change-and-your-investments/

- Values Alignment

As identified in our Strategic Plan, HCTF exists to invest in projects that maintain and enhance the health and biological diversity of British Columbia’s fish, wildlife and habitats. It is important to us that our financial investments are also working to support these outcomes.

That’s why we developed a Responsible Investing Philosophy Statement and a set of five corresponding beliefs. These beliefs guided us through our transition to 100% Responsible Investing, and they continue to form the basis for each investment decision we make.

HCTF Responsible Investing Philosophy Statement

Our team at the Foundation believe that we should implement our mission not only through the ideas, people, organizations, and projects we support, but also by how we invest and otherwise use our assets. Ensuring that our actions match our words, our team will explore and implement opportunities to align our investment practices with our mission.

HCTF Responsible Investing Beliefs

- HCTF believes that environmental, social and governance (ESG) issues can be material to investment performance and therefore should be considered throughout the investment decision‐making process.

- HCTF believes that considering ESG issues in our investment process helps the organization fulfill its fiduciary duty to act in the best long‐term interest of British Columbia’s fish, wildlife and habitats.

- HCTF believes that our investment decisions should seek to optimize risk‐adjusted financial returns and better environmental outcomes.

- HCTF believes that climate change poses a significant threat to the ongoing sustainability of fish, wildlife and habitat and to our investments.

- HCTF believes that a range of strategies, including active ownership and the stewardship of our assets, is the most effective approach to aligning our investment practices with our mission.

- Responsible Investing Plan

Our team at HCTF have developed a customized plan to achieve our Responsible Investing goals. Some highlights include:

- Biodiversity Screen –While we are investing in projects to protect and enhance biodiversity, we will not invest financially in companies that are negatively impacting biodiversity and ecosystems.

- Indigenous Conflicts Screen – We will not invest financially in companies that have known conflicts with Indigenous Nations in their communities or around the world.

- Impact Investing – Impact investing seeks to generate a positive, measurable social or environmental impact alongside a financial return. HCTF will ensure that a minimum of 10% (target 20%) of our portfolios are invested in companies that are having a positive impact.

- Low Carbon Transition Plan – Climate change poses a significant risk to the future of BC’s fish, wildlife and habitats. In an effort to reduce our investment in companies that are large contributors to the climate crisis, our low carbon transition plan saw our portfolios become fossil fuel free in 2023.

- Shareholder Engagement – Through a partnership with SHARE, HCTF is contributing to meaningful dialogue with companies on topics such as climate change and water security. This engagement aims to help companies increase the sustainability of activities and operations.

As we continue our Responsible Investing journey, our team will continually evaluate our performance and explore opportunities to increase our impact.

- Collaboration

We would be happy to share more information with any individuals or organizations that are interested in exploring Responsible Investing. HCTF is committed to helping grow this important movement.

Similarly, if you are interested in having HCTF manage and invest conservation funding on behalf of yourself or your organization, please don’t hesitate to reach out. To start a conversation, please contact our CFO Katelynn Schriner.

To assist in your research, the following websites provide useful resources and learning opportunities:

United Nations Principles for Responsible Investment: https://www.unpri.org/

CDP Global Environmental Disclosure System https://www.cdp.net/en

SHARE Shareholder Association for Research & Education https://share.ca/

Genus Capital Management https://genuscap.com/